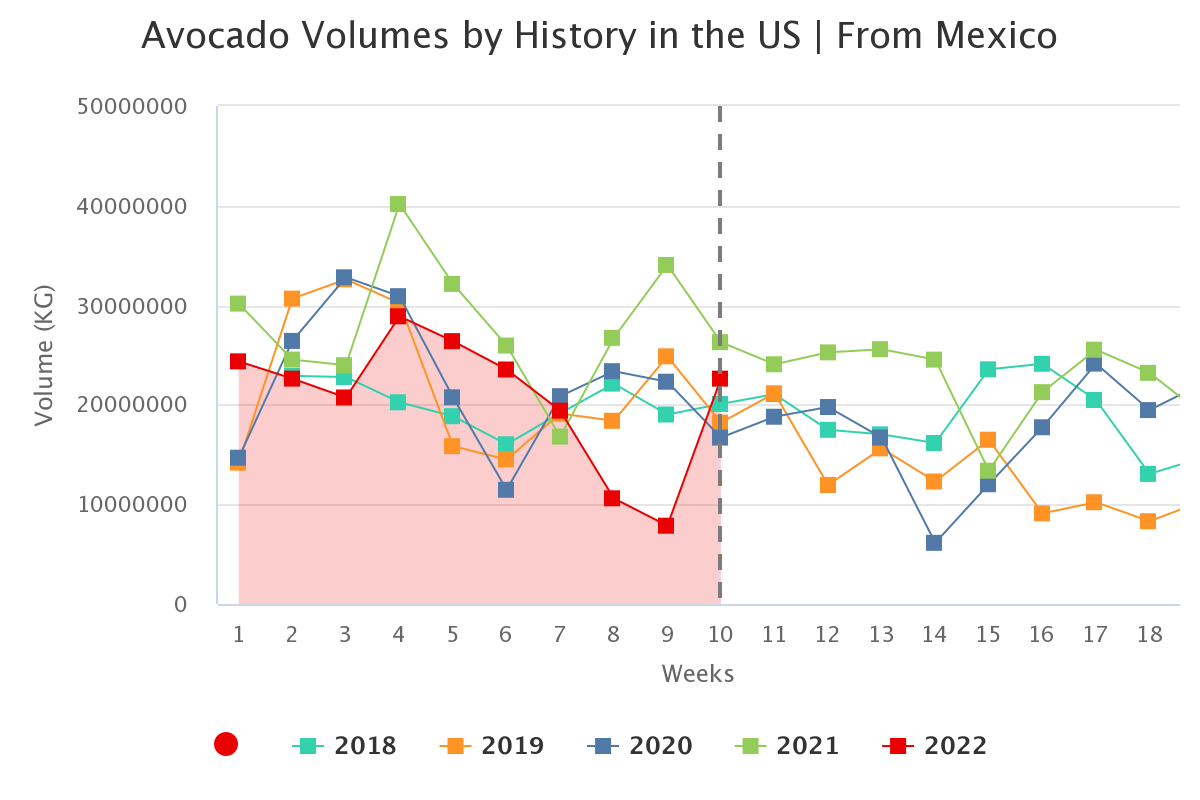

Mexican avocado volume to be impacted through Q2 but pick up later in year

Overview of avocados from Mexico in the U.S. market, complemented by charts from Agronometrics. Original published on March 15, 2022.

Mexican avocado volumes are likely to remain impacted through the second quarter of 2022, but will likely see an increase later in the year, according to executives at Mission Produce.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Speaking on a recent earnings call for the first financial quarter, Bryan Giles, Chief Financial Officer at the California-based avocado and mango company, said one of the biggest challenges being faced at the moment is lower supply levels than normal.

“Until we get through the current Mexico crop, which has been down in Q1 and will continue to be have an impact in Q2. We’re going to have issues with volume and the issues that that creates around cost absorption,” he said.

He added: “We just have to work through kind of this current harvest season, where you kind of had this abnormal decline in volumes that something we really haven’t seen to this magnitude during my time at Mission.”

However, Steve Barnard, founder and CEO, pointed out that a major cause of the current decline in Mexican avocado volume is due to alternate bearings.

“A year ago, why the supply dried up slightly and it drove those prices up and that has continued,” he said. “And as we get into the back half of 2022, you’ll see it go the other way, because the crop is larger as last year’s late crop was like this — this year’s late crop is heavier. So it’s going to shift and go the other way here in a few months.”

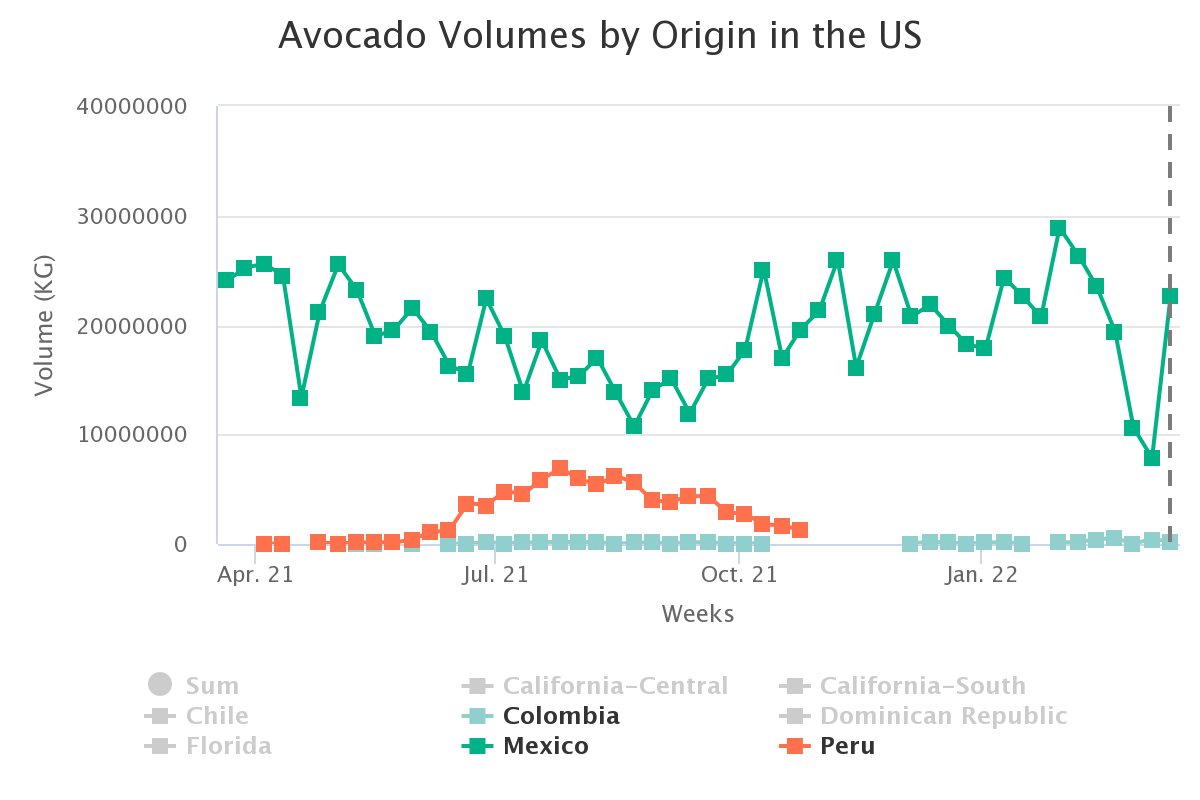

Meanwhile, he said Mission is currently looking forward to its Peru crop, with orchards in the north of the country that should start to be harvested from early April.

Giles added: We will look for opportunities to accelerate Peru and look for other countries of origin.

“But when we in the big scheme of things, the magnitude of Mexico just overwhelms it. So, I think, we’ll see increases in these other markets during Q2, but a 10% decline in Mexico will wipe out a 30% or 40% increase in some of these other areas,” he said.

He also explained that Colombia and Guatemala – two countries in which Mission Produce has invested heavily in avocado production – would have filled in the calendar at this time of the year, as it is their harvest window.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

“So I think the investments we’re making there not only will support international markets will, but over time, should be able to support the U.S. market as well,” he said.

Mission Produce experienced a disappointing first financial quarter that was affected by industry-wide rising costs and declining volumes.

The News in Charts is a collection of stories from the industry complemented by charts from Agronometrics to help better tell their story.

Access the original article with this (Link)