Peru table grape season surpasses expectations

Overview of table grapes from Peru in the U.S. market, complemented by charts from Agronometrics. Original published on May 25, 2022.

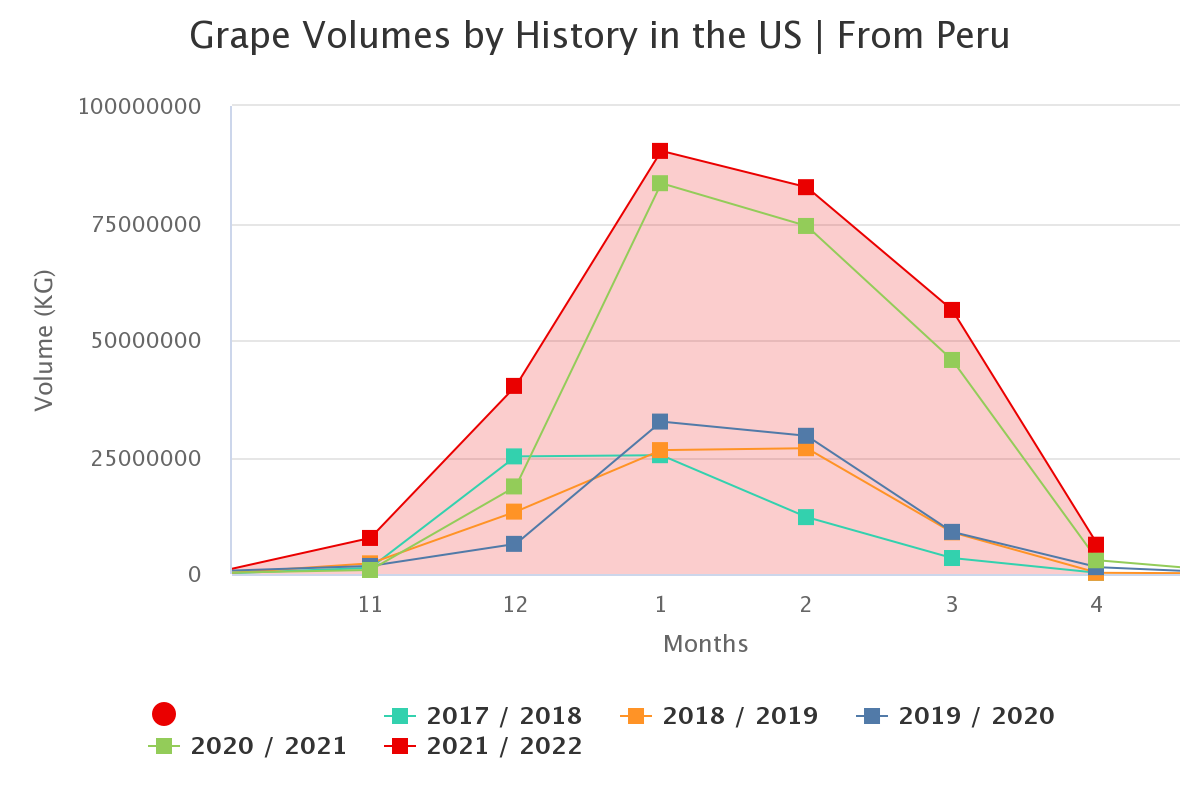

The 2021-22 the Peru table grape season is reaching its close, and despite a complicated logistical and cost scenario, the season ended up surpassing expectations of the industry, bolstered by favorable marketing conditions at its destinations.

As of this writing, and three weeks out from the close of the 2021-22 season, Peru’s table grape grower’s association Provid is not expecting any changes to its updated projections released in the middle of February.

According to their figures, the season will surpass 64 million boxes of shipped table grapes, amounting to an annual increase of 12 percent, and positioning it as the second largest table grape exporter internationally, in terms of volume.

In a statement, Provid said that the growth is due principally to the sector’s varietal diversification, and this season saw a 37 percent increase in white seedless varieties and 22 percent increase in red seedless shipments, through to January.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Furthermore Provid credits export results from the northern growing region, which is wrapping up, as well as those shipments coming out of the Ica region. But the increase in shipments was seen more in the early part of the season, from October to December, with volumes starting to decrease through January and February.

CONDITIONS ABROAD

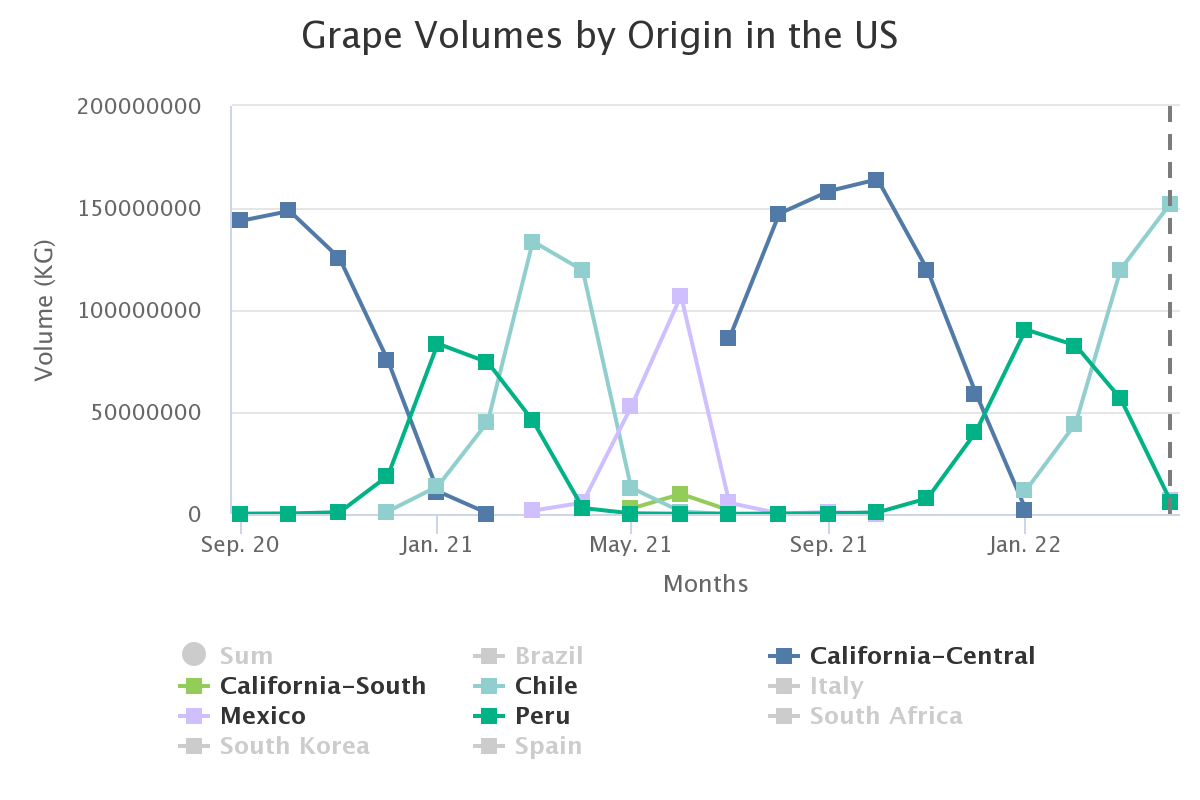

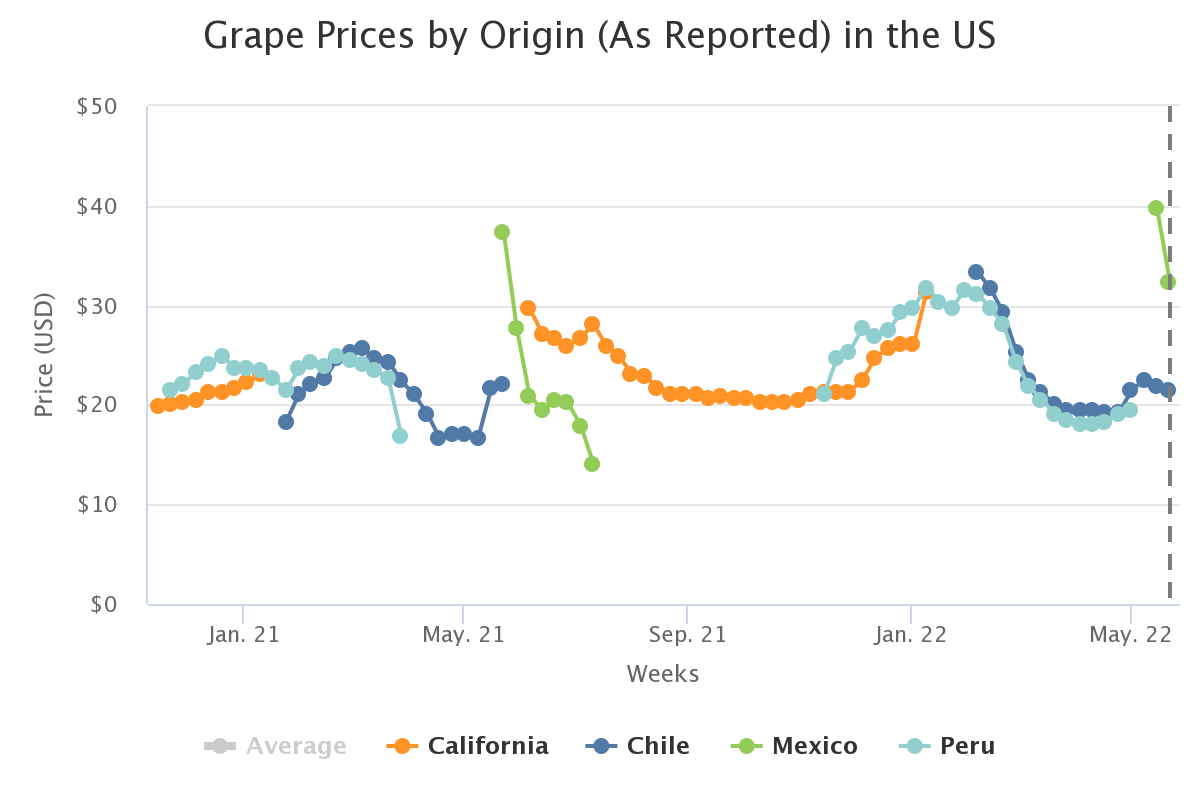

Past the harvest of Peruvian table grapes, Arturo Hoffmann, commercial manager with Don Ricardo, the success has also been seen thanks to better prices, which is a result of market dynamics involving the exit of California table grapes and delays for Chilean arrivals.

“It’s been marked by an early end to California fruit, which left the market open to Peruvian fruit from the second week of November on, ”, Hoffman told The Grape Reporter.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

The market stayed strong in terms of prices, until the end of February for all of the colors and varieties. Prices in the U.S. have been good. Chile also started later, and despite some instances of an early harvest, logistical issues meant that their arrival was delayed until the start of February.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

For Europe, South Africa started late, and also was marked by problems in logistics. For both supermarkets and the open market, it’s been good for Peru, Hoffman said. Even for Ica, which usually is not a good fit for Europe due to timing with South Africa, had better results this year.

For Asia, especially for green varieties things have been good, with the typical pressures associated with events like the Chinese New Years.

Notwithstanding, margins were affected by higher costs in production and the logistical issues. But had prices not been as good, the season would have looked much different. On average to all destinations, Hoffman estimates that there was a 10 day delay due to logistical problems over regular transit times.

Moreover this season had logistical issues not just in the U.S. West Coast, but also on the East Coast and even en route.

Looking at the season, Hoffman believes that “Peru has consolidated itself as a solid supplier of fruit in the world”.

IT COULD ALWAYS BE WORSE

For Juan Carlos Paredes of Agricola Pampa Baja, the early exit of California fruit and late arrival of Chile paved the way for a better-than-expected season.

But the concern that Paredes has is towards what is coming next for the industry. Seeing the reality of March, he said he “doesn’t know if I should be complaining about our season or be happy for what happened in December to February”.

Shipping costs have skyrocketed since the start of the Russian invasion of Ukraine, and there is also a noticeable shortage of certain kinds of fertilizers. But the shipping scenario is probably the most complicated, he added, more than the growing costs which he thought originally would be worse than other factors.

DECEMBER FOR PERU

Peru’s timing was perfect, and due to the early exit of Californian fruit from the market, Peru really had the month of December to itself as the main table grape in the market, said Capespan North America CEO Mark Greenberg.

But the first critical factor in the success for the season was arriving with an excellent quality product, Greenberg added. This trend also extended to Europe, where Greenberg said the late arrival of South African fruit also brought prime conditions for selling Peruvian table grapes, especially in the UK.

Moreover, its season started to close just as the conditions started to change, with movement slowing due to the high prices.

“They had the filet mignon for themselves and left the flank steak for everyone else” Greenberg said.

With high prices, it tends to lead to a wave of new fruit, but without retail promotions and the right conditions upon its arrival, the pace of sales slows.

And now the end result is lowered sales volume starting in March, with a market full of fruit, fruit on the water and grapes still in storage waiting to be shipped.

The News in Charts is a collection of stories from the industry complemented by charts from Agronometrics to help better tell their story.

Access the original article with this (Link)