Peruvian table grape exports to rise by 2% in 2020-21 – USDA

Overview of the Peruvian table grapes season, complemented by charts from Agronometrics. Original published on November 05, 2020.

The forecast comes in contrast to reported estimates from the Peruvian table grape association Provid in October suggesting exports would rise by 16% to 56m boxes equivalent to 8.2 kilos, which would be 426,000MT.

A USDA Gain Report said the U.S. was the top export destination in the 2019 calendar year, accounting for 38 percent of total exports.

Source: USDA Market News via Agronometrics.

(Agronometrics users can view this chart with live updates here)

Other important markets are the Netherlands and Hong Kong with 15 and 10 percent of the export market share, respectively.

Fresh table grapes are one of the top produce exports by value for Peru and 2020 export value expected to reach $1 billion. In 2020, grape prices in the export market averaged $2,333 per MT.

However, prices in the U.S. market were higher, averaging $3,053.

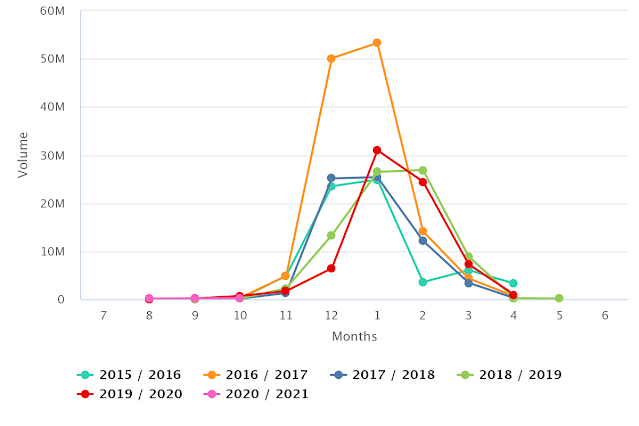

Peruvian grape exports to the U.S. peak between December and January due to seasonally higher prices. Between October 2019 and March 2020, Peru became the leading grape supplier to China accounting for 48 percent of market share.

Peru has a dry coast with a range of temperatures and over 12 hours of sunlight per day, year-round, which makes it an ideal region for grape production.

These conditions combined with precision irrigation enables Peru to mature vines 55 percent faster than in neighboring countries, the USDA report said.

Grape production is mainly located in Ica (41 percent) and Piura (22 percent), and the total area under cultivation is estimated at 31,500 hectares, the report said.

Harvesting season in Peru begins in late October and ends in April. The Red Globe variety dominates production, as it remains popular in the growing Chinese market. However, producers are shifting toward higher value varieties to supply other markets.

Grapes are one of the most expensive crops to install, second only to blueberries. One hectare of grapes in Peru requires an initial investment of approximately $43,000, without consideration of land costs.

About 30 percent of the cost of production is soil preparation and the irrigation system, 25 percent is establishing the trellis, and 14 percent goes toward the plant itself. This is a significant financial outlay for a small-scale farmer. However, the return on investment for producing high value varieties can offer sizable returns.

As a labor-intensive and high maintenance crop, the grape industry is a large employer in Peru’s agricultural sector. High production areas such as Ica boast full employment due to the steadily increasing demand for labor.

The News in Charts is a collection of stories from the industry complemented by charts from Agronometrics to help better tell their story.

Access the original article with this (Link)