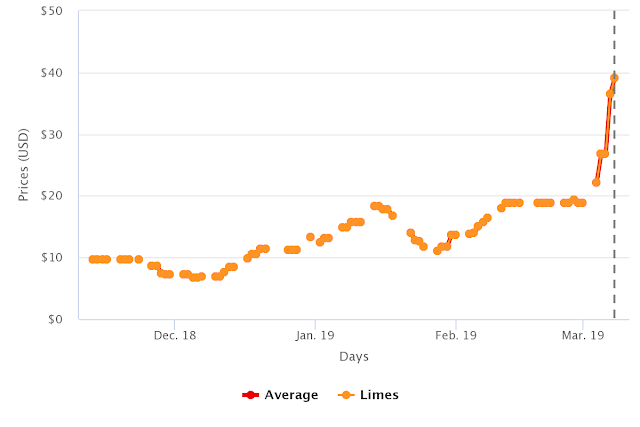

Limes in Charts – Prices Spike Doubling in one Week

Lime prices have taken a sudden upshift, doubling in the last week and making for very dramatic charts that are hard not to write about. In this article I’ll look at some historical data and what I believe are the market mechanics driving these sudden jumps.

(Source: USDA Market News via Agronometrics)

[Agronometrics users can view this chart with live updates here]

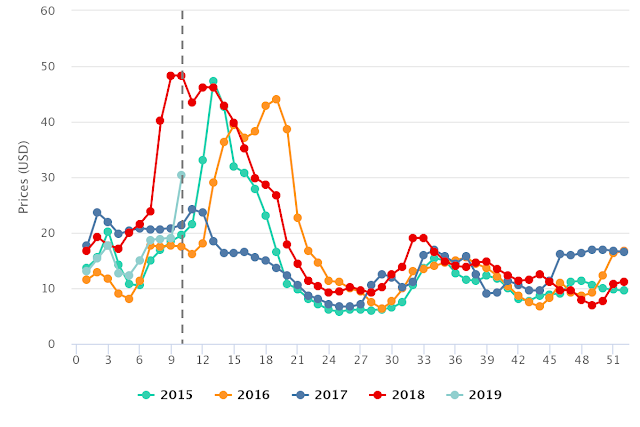

This isn’t the first time we have seen such price spikes, but the time period when this happens is a bit of a moving target. This year’s spike comes two weeks after last year’s, and before similar spikes observed other years. From the historic data, we can also appreciate that there is no obvious roof to how far the prices can go as previous years have all risen above a weekly average of USD $40 with the highest prices reaching above USD $80 in 2014.

(Source: USDA Market News via Agronometrics)

[Agronometrics users can view this chart with live updates here]

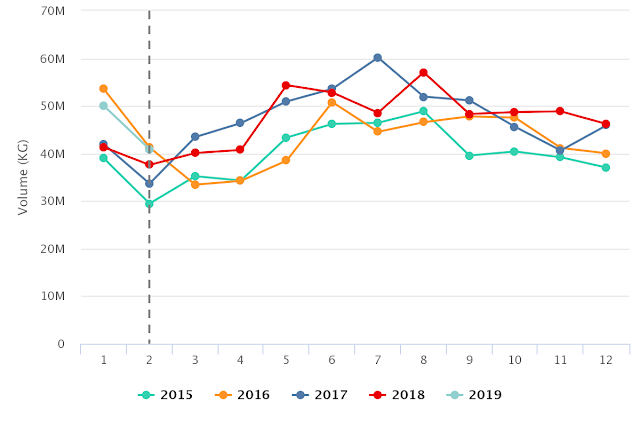

Looking at the volumes, the spikes in pricing can seem a bit counter-intuitive. It’s clear that the February-to-April period is when the least amount of fruit is typically sent by the industry, but prices seem to react very dramatically to relatively small changes in volume. An example would be looking at last month, where volumes grew only 8% compared to the previous year, however, the average price this year recorded a decrease of more than 40%.

(Source: USDA Market News via Agronometrics)

[Agronometrics users can view this chart with live updates here]

The only logical reason for this type of behavior I can come up with is that there’s a mismatch between the fruit sold at program and fruit sold on the spot market. Keep in mind that much of the lime production and imports are predestined to the beverage industry moving pre-negotiated volumes at prices that were set way ahead of time. The volumes the USDA reports do not discriminate between fruit that is coming in on a program or heading straight to the spot markets, limiting our visibility into what exactly is happening. If this hypothesis is correct it would mean that when industry pre-sells fruit to program based on their estimates of a bountiful harvest, but came up short, their first priority will be fulfilling their long term commitments, and whatever is left can be sold on the spot markets.

Considering USDA Shipping Point pricing reflects only the spot price at CIF, what I see in this data is that these scenarios where lime production is coming up short could be completely depleting the spot markets, leaving food service and resellers of limes who aren’t big enough to set up programs without fruit and desperate to get limes for guacamole and margaritas no matter the cost.

I don’t believe that I am in a position to say how the market should run, but if this diagnosis is correct, it could give some interesting perspective for producers and buyers, big and small as they look to negotiate their contracts next year.

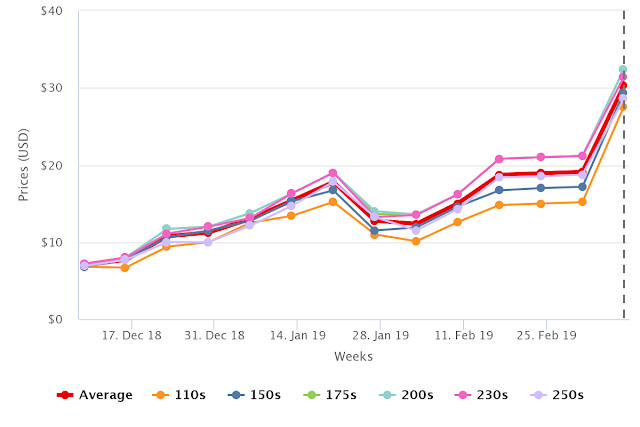

As a useful tool for readers to gauge how the markets are currently evolving, here is the updated weekly pricing by fruit size.

(Source: USDA Market News via Agronometrics)

[Agronometrics users can view this chart with live updates here]

| Sizes | Price Reported |

| Average | $30.30 |

| 110s | $27.60 |

| 150s | $29.40 |

| 175s | $32.40 |

| 200s | $32.40 |

| 230s | $31.40 |

| 250s | $28.60 |

Written by: Colin Fain

Original published in FreshFruitPortal.com on March 12, 2019 (Link)